For borrowers who need capital yesterday, hard money loans offer a lifeline that banks can’t match. Unlike traditional mortgages, these short-term, asset-based loans prioritize the property’s value over the borrower’s financial history.

With traditional financing harder to secure, borrowers are increasingly turning to hard money loans to fund flips and renovation projects. Understanding when these loans make sense is crucial for loan officers. Let’s dive into deciding factors, pros and cons, the loan process, and how loan officers can evaluate risk.

Key Takeaways

- Best for speed-driven deals: Hard money loans are most effective when timing, competition, or property condition make traditional financing too slow.

- Asset-first underwriting: Loan decisions center on collateral value and exit strategy rather than borrower credit, favoring experienced investors with defined plans.

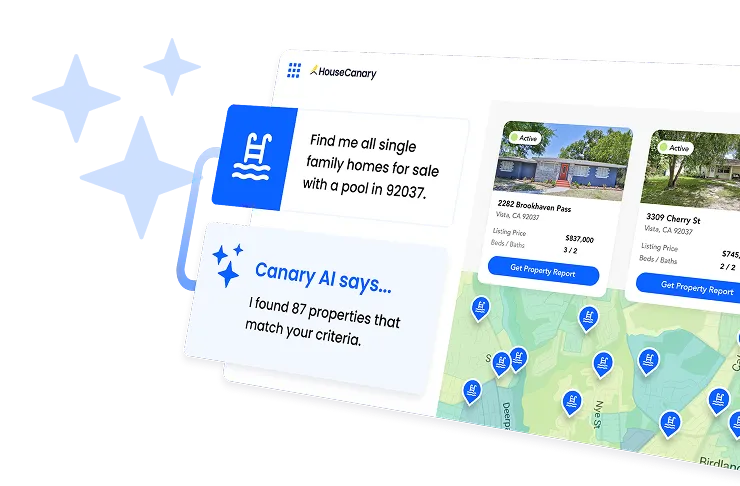

- Data tools reduce risk and delays: Using data-backed market insight tools like HouseCanary helps loan officers evaluate collateral faster and move approvals forward confidently.

What are Hard Money Loans?

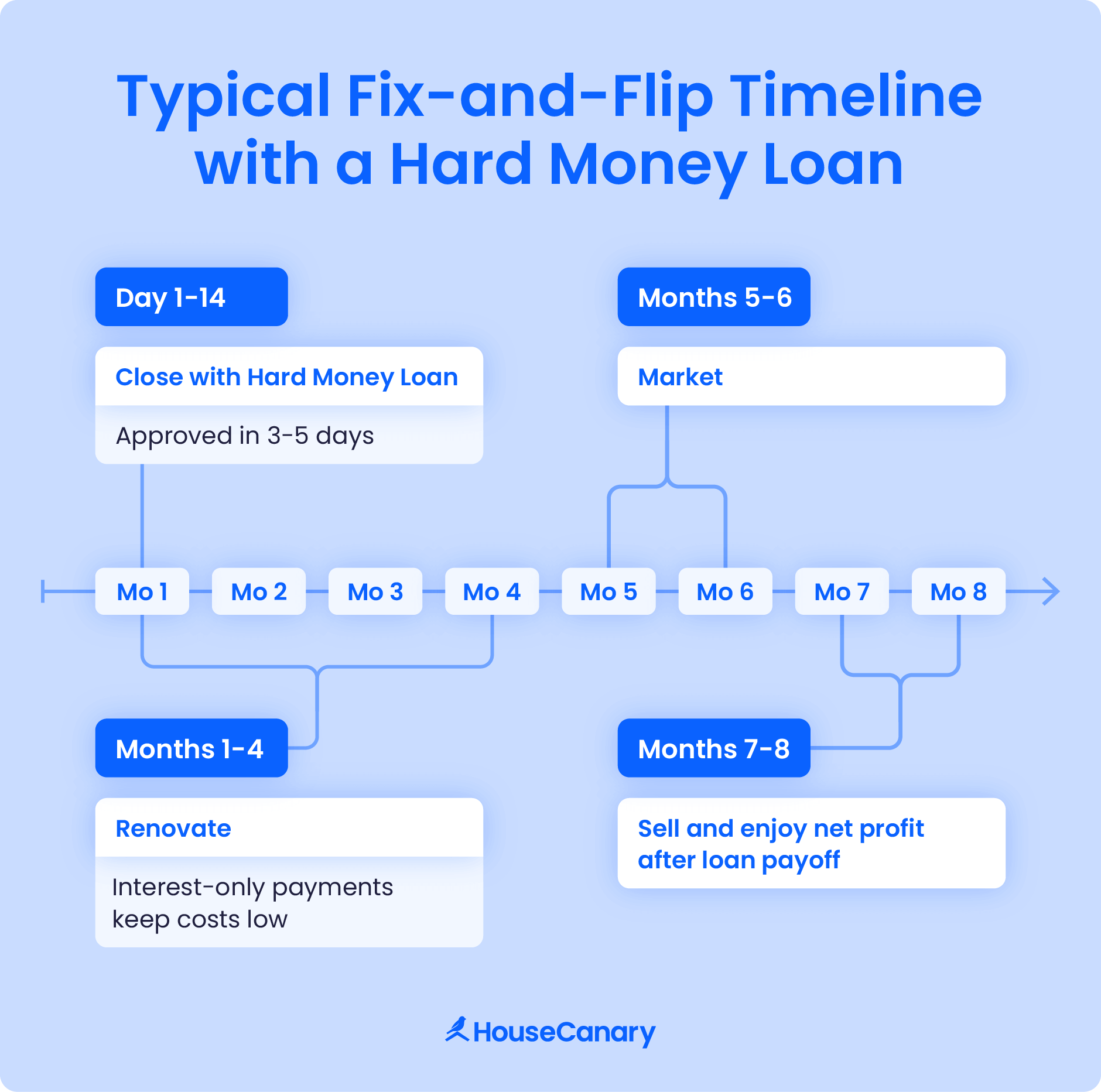

A hard money loan is a privately funded, short-term loan, usually lasting 6–24 months. It relies more on the property’s after-repair value than the borrower’s credit, and interest rates and fees are typically higher than conventional loans. These loans are often used for fix-and-flip projects, renovations, or bridge financing.

Staple characteristics of hard money loans include:

- Collateral: Secured by real estate, with loan amounts commonly based on a percentage of after-repair-value

- Payments: Interest-only payments are common during the loan term, with the remaining principal balance plus the final monthly payment due in full at maturity

- Speed: Fast funding turnaround

- Flexibility: More flexible underwriting standards than banks, with less emphasis on borrower credit history

Understanding how fast hard money loans are structured helps clarify when they’re a strategic fit and when a traditional mortgage is the better choice.

When People Use Hard Money Loans for Real Estate

As a loan officer, you likely see clients who need to move quickly in competitive markets. Hard money loans are often the solution when timing, speed, or property condition make traditional financing impractical.

Common use cases include:

- Securing off-market or distressed properties before competitors

- Financing renovations to increase resale value efficiently

- Bridging gaps between the sale of one property and the purchase of another

When hard money financing aligns with the right borrower and asset, loan officers can accelerate deal timelines, manage exposure, and structure transactions more effectively. Further strengthen your recommendations by pinpointing high-potential rental markets and investment hotspots with HouseCanary.

The Hard Money Loan Process

The hard money loan process is built for speed, making it ideal for time-sensitive transactions. Borrowers typically begin with a specific property in mind, while hard money lenders focus on evaluating the asset rather than the borrower’s full financial profile.

Typical steps in the process include:

- Property identification: The borrower selects an investment property.

- Initial screening: The loan officer confirms deal fit based on property type, location, and strategy.

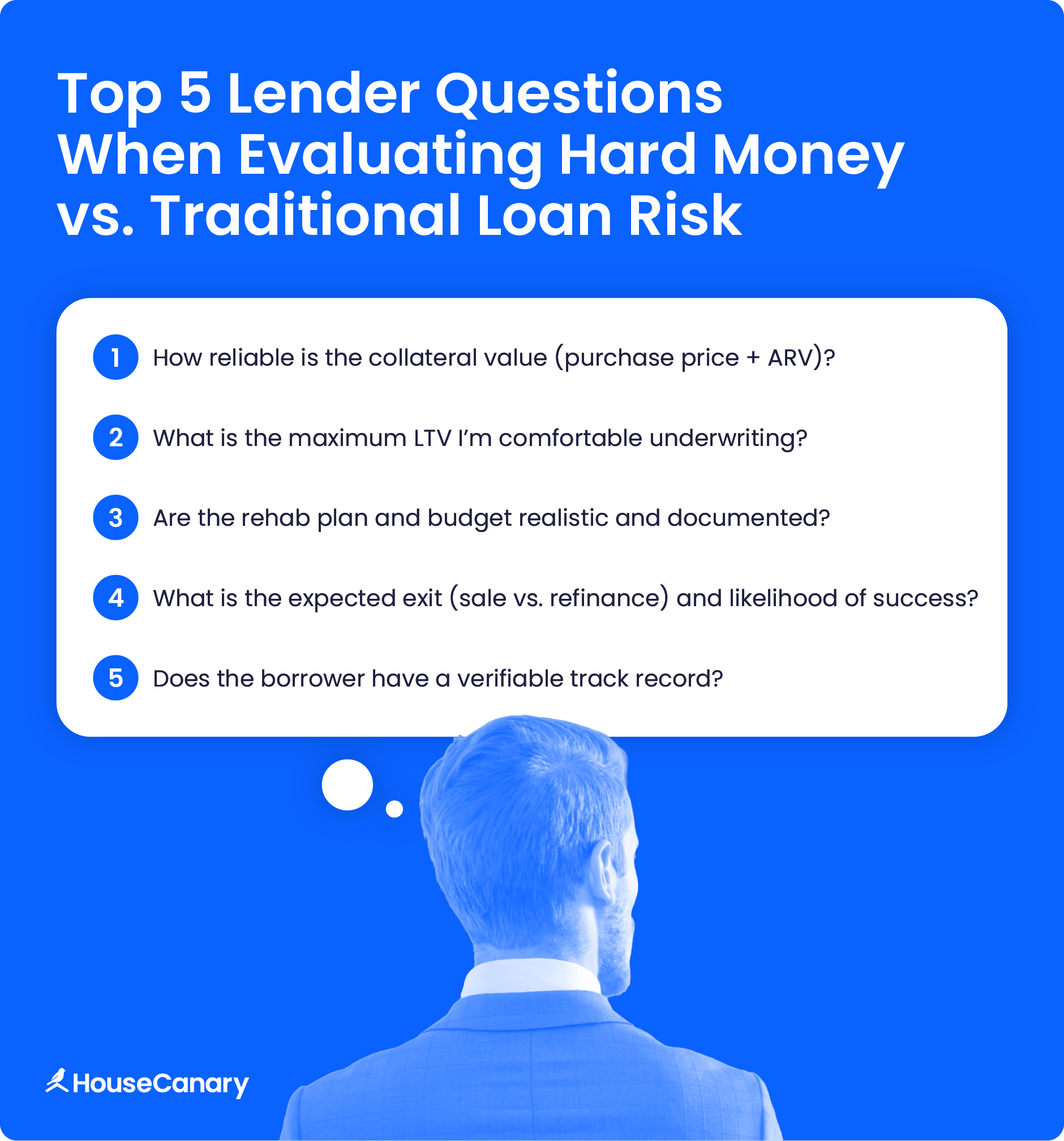

- Underwriting and valuation: The lender completes formal underwriting, while loan officers support the process by validating comps, assessing after-repair value assumptions, and preparing the deal for approval.

- Term structuring: Loan terms, pricing, and timelines are finalized based on underwriting results.

- Closing and funding: The loan closes and funds quickly, often within days.

HouseCanary speeds up underwriting by delivering instant insights into property value, neighborhood comps, and local market trends. With faster access to reliable data, loan officers can evaluate collateral, validate assumptions, and move approvals forward more efficiently.

Pros and Cons of Hard Money Loans

Hard money loans for real estate can offer an advantage in the right scenario, but they’re not universally beneficial. Understanding the trade-offs helps you guide clients toward financing that aligns with their timeline, risk tolerance, and exit strategy.

Pros

While hard money loans carry higher costs, their structure can offer distinct advantages when timing, property condition, or deal complexity matter more than rate. Understanding these strengths helps determine when hard money is the solution rather than a last resort. Several hard money loan advantages include:

- Competitive leverage in hot markets: Hard money financing can strengthen offers by enabling quicker closings, helping investors compete against cash buyers without tying up all their capital.

- Capital efficiency for experienced investors: Short-term debt helps investors preserve liquidity for multiple projects, unexpected rehab costs, or parallel deals.

- Viable path for unconventional properties: Properties that don’t meet traditional lending standards (due to condition, zoning, or incomplete income history) may still qualify, opening doors that banks typically close.

- Clear alignment with defined exit strategies: When paired with a realistic sale or refinance plan, hard money loans can act as a bridge rather than a long-term obligation.

Cons

The same features that make hard money loans attractive can also amplify risk when a deal doesn’t go as planned. Short terms, higher carrying costs, and reliance on a clear exit strategy require careful evaluation from the start. Several hard money loan drawbacks include:

- Higher total cost of capital: Elevated interest rates, origination fees, and carrying costs can quickly erode margins if timelines slip or market trends change.

- Compressed repayment timelines: Short loan terms leave little room for delays in construction, permitting, or resale, increasing pressure on execution.

- Greater exposure if the exit falters: If a sale or refinance doesn’t go as planned, borrowers may face costly extensions or forced asset sales.

- Significant equity at risk: Lower loan-to-value ratios mean borrowers must contribute more upfront capital, increasing potential losses if the deal underperforms.

- Poor fit for long-term strategies: Buy-and-hold investors typically benefit more from stable, lower-cost financing designed for extended ownership durations.

Hard Money Loan Alternatives

While hard money loans can be highly useful, borrowers have other options depending on their timeline, budget, and project type. Hard money loans are generally faster and more flexible but come at a higher cost, while alternatives trade speed and flexibility for lower rates and longer terms.

Hard Money Loan Risk Insights Powered by HouseCanary

Hard money loans carry higher costs and short terms, so loan officers need precise property data to advise confidently. HouseCanary provides AI-powered valuations, comps, forecasts, and market insights to validate collateral and reduce turnaround times.

With HouseCanary, you can track multiple properties, monitor LTV changes, and receive alerts on valuation shifts or listing status updates, helping you manage risk across client portfolios.

Get started with Portfolio Monitor today and stay ahead of market and portfolio risks.

Frequently Asked Questions

Are Hard Money Loans a Good Investment?

Hard money loans can be good investments for experienced investors seeking short-term gains or quick flips. However, higher costs and risks make them less suitable for long-term or buy-and-hold strategies.

Do Buyers Need Good Credit to Get a Hard Money Loan?

Hard money loans focus on the property’s value and the borrower’s exit strategy rather than traditional credit scores.

How Long Does a Hard Money Loan Last?

Hard money loans typically last 6 to 24 months, depending on the project timeline and lender terms.

What are the Common Terms for a Hard Money Loan?

Hard money loan interest rates are higher than conventional loans, often 10-18%, with interest-only payments, lower LTV ratios, and short repayment schedules.