After-repair value (ARV) is the number every flipper chases. It’s your property’s projected worth after the work is done and the profits can roll in. It’s an important figure for anyone hoping to buy low, fix up, and sell high.

As home flipping becomes more competitive and data-driven, accurate ARV estimates are more important than ever. This article explains the ARV meaning and how to calculate ARV step by step and how tools like HouseCanary’s data can help evaluate investments and boost returns.

Key Takeaways

- ARV accuracy is critical: To help investors make informed investment decisions, evaluate potential profits, and avoid costly mistakes.

- Market trends and expenses can impact valuation: Include holding, transaction, and unexpected expenses for a comprehensive ARV calculation.

- Data-driven platforms like HC simplify ARV: Instantly access condition-adjusted valuations and forecast market shifts for more strategic investment decisions.

What Does ARV Mean in Real Estate?

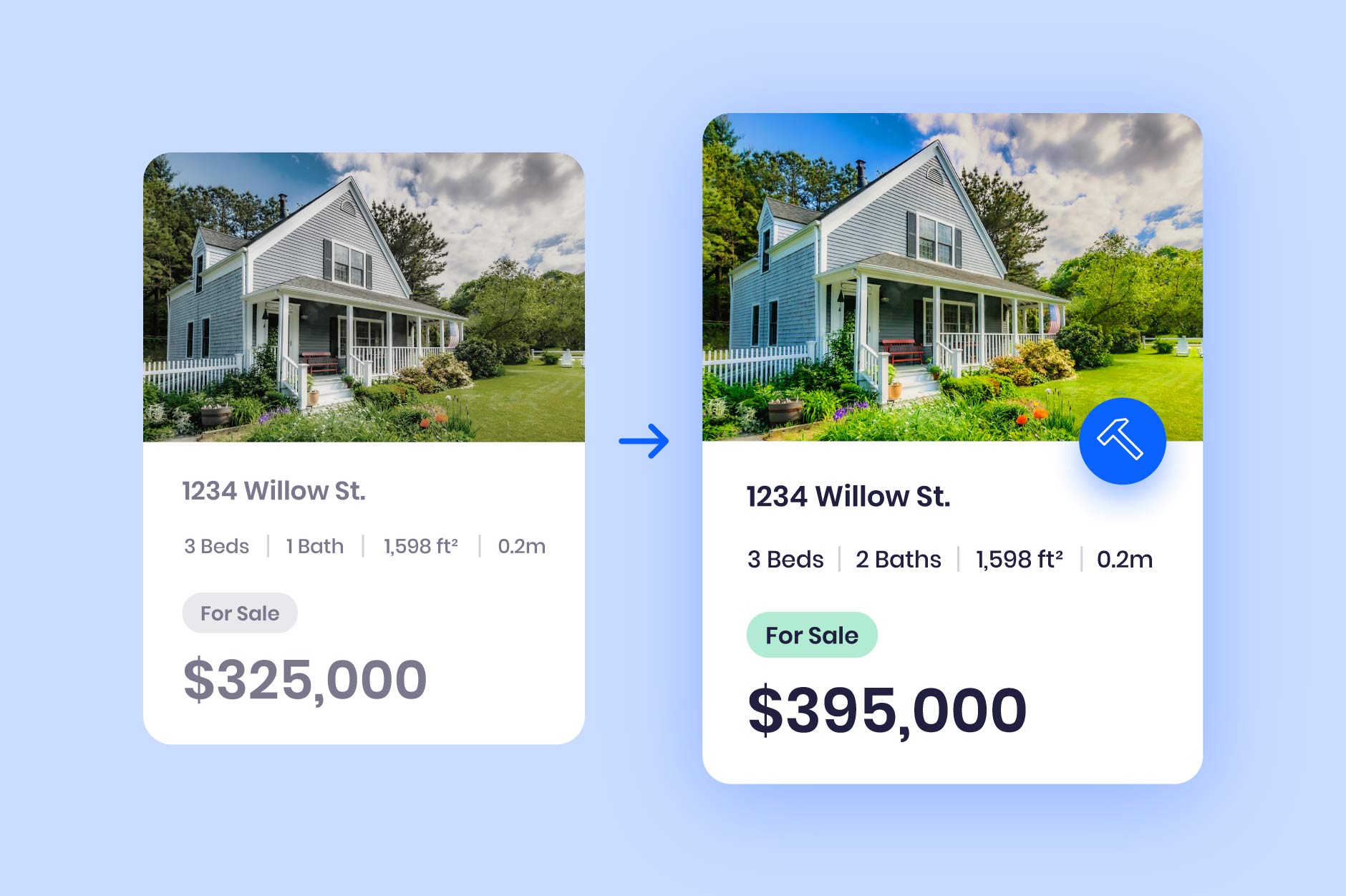

ARV in real estate is the market value of a property after it undergoes renovations. Its main purpose is to help investors estimate a property's potential resale value after improvements, guiding critical decisions during the investment life cycle.

Unlike a current market value, which reflects a property’s condition today, ARV projects the true value of a real estate investment post-rehab. It’s most common during:

- The purchase phase to determine a maximum offer price

- Renovation planning to avoid over-improving

- Resale or refinancing to assess potential profit or borrowing capacity

From ARV to ROI: 3 Steps to Evaluate a Real Estate Deal

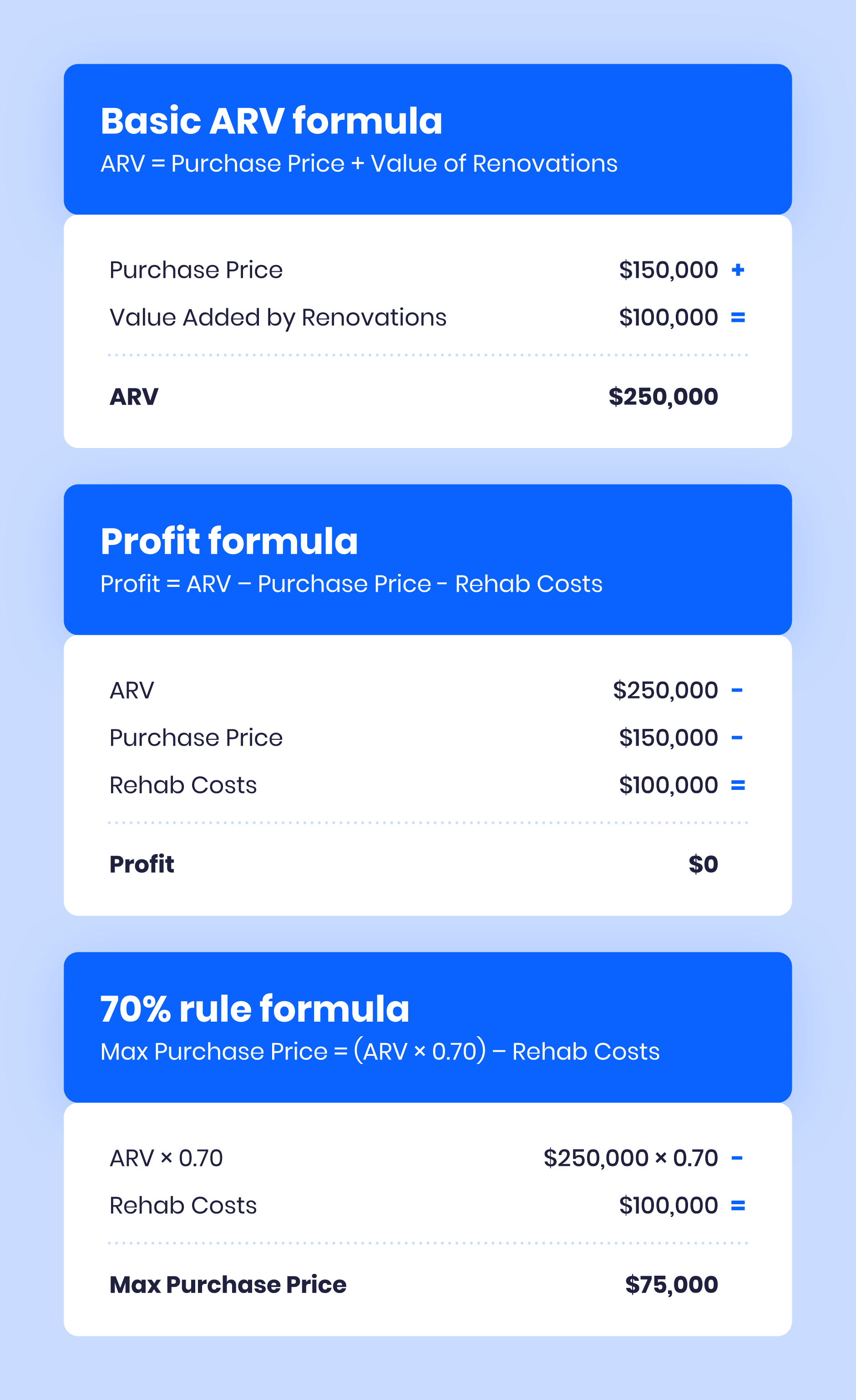

The ARV formula is essentially a property’s current value plus the value of planned renovations. Many investors use this basic formula:

ARV = Purchase Price + Renovation Costs

However, the more accurate method is to base ARV on comparable sales of similar renovated homes.

Since market trends and unexpected expenses can affect your projections, it’s important to take a comprehensive approach. Learning to proactively track investment property performance helps you stay ahead of changes that impact your property’s value and profitability.

Let’s walk through how to calculate ARV and use it to evaluate a property’s profit potential.

Step 1: Estimate Post-Rehab Market Value

Start by estimating the property's worth after renovations. This means analyzing comps, similar homes in the same area that have recently sold in updated condition. Look for matches in size, layout, and finish.

Market trends also factor into this value. A comp from two months ago might not reflect today’s pricing, and rising or cooling markets can impact your ARV projection significantly.

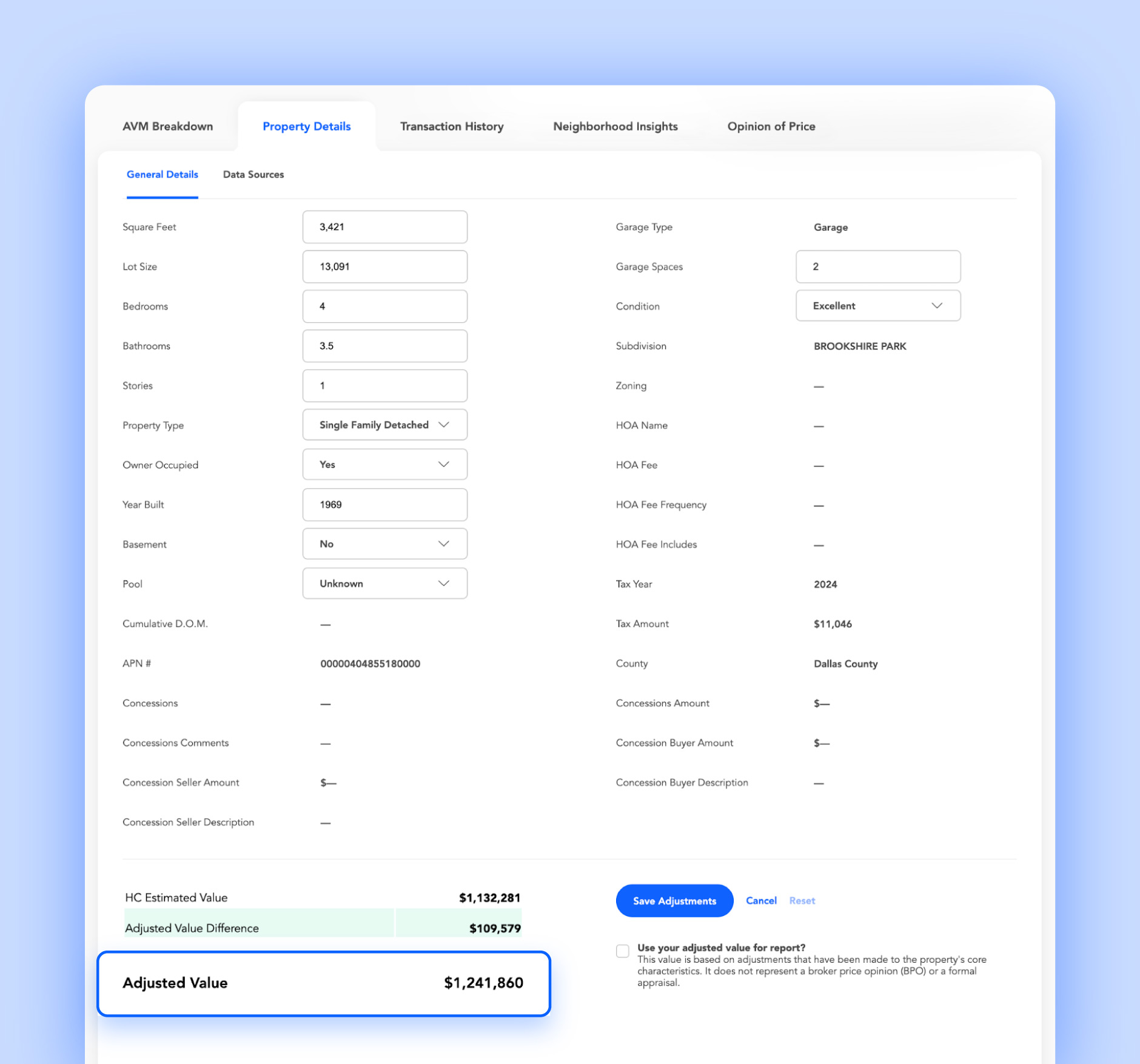

HouseCanary’s Property Explorer simplifies this process. You can adjust the home’s condition to reflect post-rehab upgrades and instantly see the estimated ARV. For developers, the Value at Six Conditions API feature found in HouseCanary’s Data Explorer offers fast, programmatic access to ARV projections.

Step 2: Estimate Rehab Costs

Once you know the projected ARV, the next step is calculating what it will take to get there. Rehab costs include labor, materials, permits, contractor fees, and a contingency buffer for issues like mold, structural damage, or required code upgrades.

This step doesn’t affect the ARV itself, but it’s a critical input when evaluating whether a deal makes financial sense.

Accuracy is key. Underestimating costs will shrink your profit, while overestimating could make you pass on a viable deal. Break your budget into line items, and when possible, get contractor quotes to validate your numbers.

Step 3: Calculate Potential Profit Margin

Now it’s time to calculate the potential profit margin. Subtract the purchase price, rehab costs, and additional expenses (like closing fees, holding costs, and selling commissions) from your ARV.

What’s left is your potential profit. Many investors aim for at least a 10-20% return, but acceptable margins vary depending on risk and market conditions. This step ensures you're not just making assumptions and confirms whether the deal actually meets your financial goals.

Bonus: Use the 70% Rule as a Quick Deal Filter

The 70% Rule is a popular shortcut for evaluating flip deals. It suggests you should pay no more than 70% of the ARV minus repair costs. The formula looks like this:

Maximum Purchase Price = (ARV × 0.70) – Rehab Costs

This gives you a quick ceiling price to help preserve your profit margin. However, it is only a general guideline. Use the 70% Rule to screen deals quickly, but always confirm your numbers with real market data.

Investors often use the 70% Rule during the early stages of deal analysis, especially when sorting through multiple potential properties. It’s a fast way to eliminate overpriced homes without diving into a full CMA or appraisal. While a more detailed analysis is needed later, this rule is especially helpful in hot markets where speed is essential.

HouseCanary’s tools help further validate whether a deal truly meets your margin goals by analyzing comps, local trends, and property-specific insights. With accurate, real-time data, you can move beyond general guidelines and make smarter, more confident investment decisions.

Common Mistakes When Estimating ARV

Even if you follow the right steps, it’s easy to make mistakes that throw off your ARV calculations. Small errors can lead to overpaying for a property or missing out on potential profit.

Here are some of the most common ARV estimation mistakes and how to avoid them:

- Using outdated or noncomparable comps: Relying on sales that are too old or dissimilar in size, location, or condition can distort your ARV. Always use recent comps that reflect what your property will look like post-renovation.

- Overlooking necessary property upgrades: Failing to accurately account for the level of renovation or upgrades needed can lead to inflated ARV estimates. Be realistic about the improvements required to reach the projected value.

- Ignoring local market shifts: Real estate markets change quickly. What sold six months ago might not reflect today’s values. Always track up-to-date trends and pricing shifts in your area.

- Overlooking holding and transaction costs: ARV is only part of the picture. When assessing your potential profit, don’t forget to factor in costs like property taxes, utilities, insurance, agent fees, and closing costs.

HouseCanary helps you avoid these errors by offering detailed comps, neighborhood performance trends, and forecasting tools through CanaryAI that highlight where values are headed.

When you adjust property details and conditions within our platform, we provide an instant ARV based on our advanced automated valuation models (AVMs). These quick insights offer the context needed to identify the best markets and make more strategic investment decisions.

ARV Limitations

ARV is highly valuable in calculating resale value; however, keep your eye on several limitations. Understanding these drawbacks can help you use ARV as part of a broader, more informed investment strategy rather than relying on it exclusively.

Several limitations include:

- Does not account for financing risks: Fluctuations in interest rates or lending standards can affect your ability to refinance or sell quickly at the projected ARV, influencing overall returns.

- Lacks consideration for unique property features: Properties with unusual layouts, historical designations, or other special characteristics might not fit neatly into comps used for ARV.

- Assumes stable economic conditions: ARV estimates can be disrupted by unexpected economic downturns, job market shifts, or changes in local infrastructure that affect housing demand.

Platforms like HouseCanary use real estate AI tools to help you address these limitations and gain deeper insights into lending environment data, property specifics, and market forecasts. This data-driven approach helps you make more accurate ARV estimates.

Why Accurate ARV Estimates Are Crucial

Accurate ARV estimates offer a realistic big picture for home flippers and other real estate investors. They show the total impact on ROI for flippers, helping to determine whether a project is financially viable before committing time and money.

Hard money lenders also rely on ARV to assess risk and determine loan amounts, typically lending a percentage of the projected ARV rather than the purchase price. An inflated or inaccurate ARV can lead to funding shortfalls or denied financing.

ARV also directly influences assignment fees for wholesalers. A well-substantiated ARV helps justify the amount between the purchase contract and resale to an end investor.

Ultimately, accurate ARV calculations serve as a key risk mitigation tool. They help investors avoid overpaying, identify potential deal-breakers early, and set realistic profit expectations in shifting markets.

Use ARV to Make Smarter Investments

ARV estimates offer a strategic edge and help you beat the competition with better market data. They allow investors to assess profitability, secure the right financing, and avoid costly mistakes. With high-quality data, you can reduce risk, find better opportunities, and invest confidently.

Ready to invest with greater accuracy and less guesswork? Sign up for HouseCanary and start using our Property Explorer tool, powered by over 100 million property valuations annually, to make faster and data-backed investment decisions with confidence.

.jpg)