Buying a new home is an exciting milestone, but it's not uncommon to find the sellers still paying off their mortgage. A popular solution to this is an assumable mortgage. Rather than applying for a new mortgage, buyers can take over the seller's existing assumable loan.

But many buyers hesitate because they’ve heard the process can be complicated, drawn out, and filled with red tape. That uncertainty can make it difficult to know whether pursuing an assumable mortgage is really worth it.

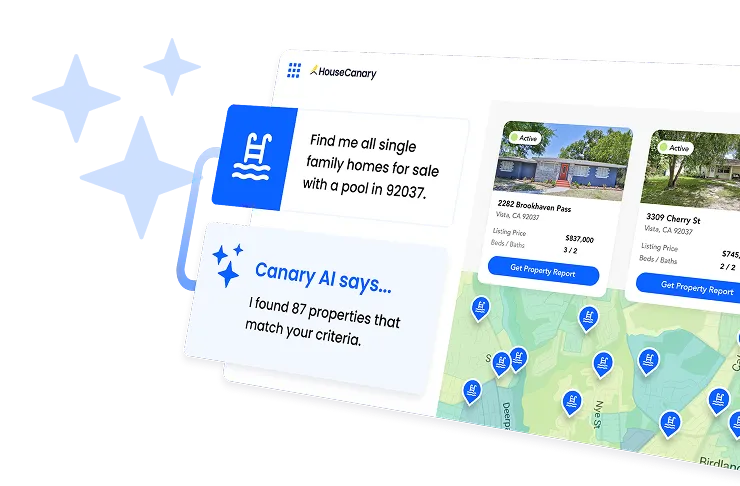

Real estate software like HouseCanary, combined with the strategies covered in this article, can help you evaluate loan types, analyze market trends, and determine whether the advantages of an assumable mortgage outweigh the drawbacks.

What Is an Assumable Mortgage?

An assumable mortgage is a home loan that a buyer can take over from the current homeowner, effectively stepping into their existing loan. The biggest benefit for buyers is the ability to retain the original interest rate and loan terms.

While conventional loans are rarely assumable, certain government-backed loans often are. If the existing rate is lower than today’s market rates, buyers could save thousands of dollars over the life of the loan.

Different types of assumable loans:

- FHA loans: Generally assumable with lender approval

- VA loans: Assumable, sometimes with restrictions tied to eligibility or entitlement

- USDA loans: Assumable if the buyer meets USDA eligibility requirements

Agents can identify which properties may offer this unique financial advantage for their buyers by understanding the distinction. Combining this with housing market forecasts helps you stay ahead of the market.

.png)

How Does an Assumable Mortgage Work?

Assuming a mortgage requires coordination between the buyer, seller, and lender. Here’s a walkthrough of how to assume a loan:

- Seller has an eligible assumable loan: Only certain mortgages, as previously mentioned, may be eligible for assumption.

- Buyer applies to assume the mortgage: The prospective buyer submits an application to the lender, including financial and credit information.

- Lender reviews and approves the buyer: The lender evaluates the buyer’s creditworthiness and ability to meet the existing loan terms.

- Buyer covers the equity difference: If the home’s market value exceeds the remaining mortgage balance, the buyer pays the difference through a down payment or a second loan.

- Closing and legal transfer: Once approved, the mortgage responsibility officially transfers to the buyer, completing the assumption process.

This process allows buyers to step into an existing loan while taking advantage of favorable interest rates and terms, though lender approval and upfront costs are other important considerations.

Pros and Cons of Assumable Mortgages

While an assumable mortgage sounds like a great option, there are also disadvantages to consider against the advantages.

Pros

Several pros of assumable mortgages include:

- Lower interest rate than today’s market: Buyers can take over a mortgage with a rate potentially below current market levels.

- Potential long-term savings: Maintaining the original loan terms can reduce overall interest costs over the life of the loan.

- Smoother financing in high-rate environments: Assumable mortgages can simplify the buying process when new loans come with higher rates or stricter terms.

Cons

However, there are also potential cons, including:

- Limited availability: Only certain types of loans are typically assumable.

- Lender approval required: Buyers must meet the lender’s credit and income requirements to assume the mortgage.

- Upfront cash needed: Buyers may need substantial funds to cover the difference between the home’s market value and the remaining loan balance.

Understanding both the benefits and limitations of assumable mortgages can help your buyers make informed decisions and identify opportunities to save on their next home purchase.

Who Typically Benefits from an Assumable Mortgage?

Certain buyers and sellers can gain a distinct advantage from assumable mortgages:

- First-time buyers seeking affordability: Lower interest rates and predictable loan terms can make homeownership more accessible.

- Military buyers (VA loans): Eligible service members can take advantage of VA loan assumptions, often with favorable terms.

- Sellers: Offering an assumable mortgage can make a property more exciting for potential buyers.

- Real estate investors: Investors can reduce long-term financing costs by assuming an existing low-rate mortgage.

With HouseCanary Data Explorer, they can quickly assess a property’s full financial profile—including value, equity, liens, disaster risk, and rental potential—to evaluate opportunities.

By matching the right buyers and sellers with data-driven insights, assumable mortgages can become a powerful tool for creating win-win transactions.

Assumable Mortgage Best Practices

Following best practices can help buyers and sellers maximize the benefits of an assumable mortgage while minimizing risk and uncertainty. These tips help simplify the process of assuming a mortgage:

- Confirm loan eligibility early: Verify whether the existing mortgage is assumable before moving forward with anything else. Focus on FHA, VA, or USDA loans, as conventional loans are rarely eligible.

- Understand lender requirements: Buyers must meet credit and income standards, and sellers should confirm whether a release of liability is needed to avoid future risk.

- Assess equity and upfront costs: Determine if the buyer can cover the difference between the home’s market value and the remaining mortgage balance through a down payment or secondary financing.

- Factor in closing costs: Even though the loan is assumed, fees for the lender, title insurance, and recording may still apply.

- Use data-driven tools: Platforms like HouseCanary can provide insights into loan history, equity positions, neighborhood trends, and overall property value to help make informed decisions quickly.

- Consider working with an experienced agent: Agent expertise is critical for identifying assumable loans, validating eligibility, and guiding both buyers and sellers through the process efficiently.

How to Find Assumable Mortgages in Today’s Market

Assumable mortgage listings are valuable but can be tricky to locate. Because only certain loan types are typically eligible, these opportunities don’t always appear in standard listings. Many MLS platforms and listing sites don’t clearly flag assumable loans, making them harder for buyers to identify.

Agent expertise is critical in detecting these listings, confirming eligibility, and guiding clients through the lender’s approval process. Being able to find and validate assumable mortgages can set you apart in a high-rate market, giving your clients valuable insights and access to ideal opportunities.

For a data-driven approach, HouseCanary’s platform allows users to filter properties by location, value, and other key characteristics—then drill into details like loan type, equity, and real estate market trends to identify potential assumable mortgage opportunities.

.jpeg)

How HouseCanary Helps You Evaluate Properties with Assumable Mortgages

As discussed, assumable mortgages can create major opportunities for buyers, but they also come with challenges that make it hard to know if the deal is really worth it. That is where the right data and analysis can make all the difference.

With HouseCanary, you can go beyond simply spotting hot properties. You can verify loan types, assess equity positions, and analyze neighborhood market trends in one place.

This means you can quickly determine whether an assumable mortgage offers real long-term value, estimate potential savings, and compare it to other opportunities on the market. Centralizing this information helps you save time, reduce guesswork, and give clients or investors better data to beat the competition with.

Sign up for HouseCanary to start identifying your next opportunity today.

FAQ about Assumable Mortgages

Can I Assume Any Mortgage?

No, only certain loans are assumable. Standard conventional loans are generally not assumable unless it is explicitly stated in the original loan terms. The most common types of assumable loans are government-backed mortgages, including FHA, VA, and USDA loans.

Do I Need Good Credit to Assume a Loan?

The lender must approve the buyer, which usually requires meeting credit and income requirements similar to applying for a new mortgage. In most cases, buyers will need at least a 620–640 credit score for FHA or USDA loans, while VA loans may allow a bit more flexibility depending on the lender.

What Happens to the Seller’s Liability?

The seller’s liability depends on the loan type. With FHA and VA loans, sellers may remain liable unless the lender issues a release, and VA loans can affect future entitlement if not restored. Once the assumption is approved and the release is granted, the buyer takes full responsibility, so sellers should always confirm their liability ends with the transfer.

Do You Have to Put Money Down on an Assumable Mortgage?

Typically, you do have to put money down in an assumable mortgage. If the home’s market value is greater than the remaining mortgage balance, the buyer must cover the difference through a down payment or a secondary loan.

Do You Pay Closing Costs When You Assume a Mortgage?

Yes, even though you’re taking over an existing loan, assumable mortgages typically involve closing costs. These can include lender fees, title insurance, and recording fees (similar to a standard home purchase).

Disclaimer: This is not investment advice. Please consult with a financial professional about your individual situation.