In today's dynamic real estate market, understanding a property's true value is crucial not only for homebuyers and sellers, but entities like residential real estate investors and mortgage lenders whose businesses center around equity and credit stakes in single-family properties. Automated Valuation Models (AVMs) have emerged as a popular tool for generating quick estimates for anything from gauging the fairness of a home’s listing price to valuing a home to determine loan risk. But, not all AVMs are created equal. This article discusses the differences between underwriting grade AVMs, like HouseCanary's gold standard, highly accurate AVM, and marketing AVMs like our Property Estimate endpoint and estimates commonly found on popular real estate search sites.

Underwriting Grade AVMs: The Power of Data-Driven Insights

An underwriting grade AVM is a sophisticated computer-generated valuation that utilizes a robust dataset to estimate a property's fair market value. At HouseCanary, for example, we leverage a massive 114M-plus property database of public records, property characteristics, and advanced machine learning algorithms to deliver highly accurate valuations. Here's a breakdown of what sets underwriting grade AVMs apart from Marketing AVMs:

- Data Depth and Quality: Underwriting grade AVMs rely on extensive, high-quality data sources. HouseCanary's dataset goes beyond public records, incorporating geospatial information, property attributes, and local market trends. This comprehensive approach ensures a more nuanced understanding of the factors that influence value. Underwriting grade AVMs also include data points that provide additional context and statistical measures to help users understand the valuation and gauge the level of certainty associated with it. Here's a breakdown of those data points:

- Confidence: This metric indicates the model's certainty in the estimated value. It's a way to quantify how sure the AVM is about the accuracy of its valuation. A higher confidence score suggests the AVM is more confident in its estimate.

- Forecast Standard Deviation (FSD): This reflects the statistical dispersion of valuations around the estimated value. Imagine a bunch of valuations plotted around the AVM's estimate as the center point. The FSD tells how spread out those valuations are. A lower FSD indicates the valuations are tightly clustered around the estimate, suggesting greater precision. A higher FSD suggests more uncertainty because there is more variation in the valuations.

- Upper Confidence Interval (upper): This represents the higher end of a range within which the true fair market value is likely to fall, with a certain level of confidence. It provides an upper bound for the estimated value.

- Lower Confidence Interval (lower): This represents the lower end of the range within which the true fair market value is likely to fall, with a certain level of confidence (typically 95%). It provides a lower bound for the estimated value.

These additional data points paint a more comprehensive picture of the valuation and the level of certainty associated with it.

- Advanced Analytics: Underwriting grade AVMs employ sophisticated algorithms, like machine learning, to analyze vast quantities of data. These algorithms identify complex patterns and relationships between property features, market conditions, and recent sales. HouseCanary's AVM utilizes a multi-model approach, combining statistical models with machine learning for exceptional accuracy.

- Focus on Accuracy: Unlike marketing AVMs, underwriting grade AVMs prioritize providing a reliable estimate of a property's fair market value. HouseCanary is committed to transparency, providing confidence intervals alongside valuations to illustrate the estimated range of value.

Marketing AVMs: A Convenient Starting Point

Marketing AVMs, often seen on popular real estate search websites, offer a quick and easy way to get a ballpark figure for a property's value. These AVMs typically use readily available data, such as public records and past sales in the vicinity. While convenient, it's important to understand their limitations:

- Limited Data Scope: Marketing AVMs often rely on readily available public data, which may be incomplete or outdated. House characteristics like upgrades, renovations, or condition are not typically considered, leading to potential inaccuracies. Essentially, a marketing AVM is just a point estimate with little to no other information.

- Focus on Marketing: Marketing AVMs can be influenced by a desire to attract buyers or sellers. An overvalued estimate might entice a seller to list on a particular platform, while an undervalued estimate might attract more buyers.

- Lower Accuracy: Due to limitations in data and methodology, marketing AVMs often have a wider margin of error compared to underwriting grade AVMs. This can lead to misleading estimates, particularly for unique properties or volatile markets.

HouseCanary's AVM: Precision And Transparency

HouseCanary's AVM represents a significant leap forward in real estate valuation technology. Here's what makes our AVM the most accurate:

- Transparency by Design: HouseCanary provides confidence intervals alongside its valuations. This transparency empowers users to understand the estimated range of a property's value and make informed decisions.

- Unmatched accuracy: Our AVMs are recognized by third-party testing as the most accurate AVM in the market.

- Nationwide coverage with a 50-state brokerage and MLS access.

- 35 years of most accurate real estate data, normalized and enhanced with image recognition.

- Pre-list and purchase benchmark testing for a holistic view of market value.

- Monthly fairness assessments to eliminate bias.

When to Use Each Type of AVM

Underwriting grade AVMs are ideal for situations where accuracy is paramount. For real estate professionals, lenders, and investors, an underwriting grade AVM like HouseCanary's provides a reliable foundation for decision-making. This is particularly important for:

- Loan Origination: Lenders utilize underwriting grade AVMs to assess property values and determine loan eligibility. HouseCanary's AVM offers the accuracy and reliability needed for responsible lending practices.

- Investment Analysis: Investors rely on accurate valuations to make informed investment decisions. HouseCanary's AVM empowers investors with reliable insights to optimize their portfolios.

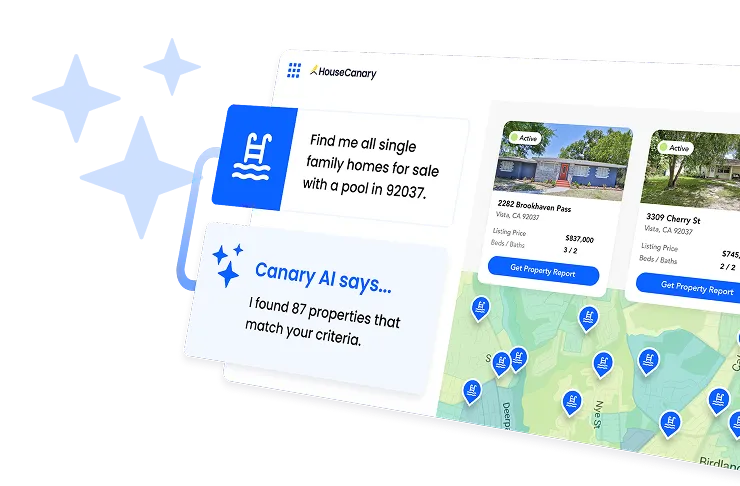

Our underwriting grade AVM is included in many of our data and valuations solutions, including Property Explorer, our custom property valuation and comparables selection tool.

Marketing AVMs, while not as precise, can be a useful starting point and allows lenders, investors, and PropTech companies to scalably reach potential customers who are actively interested in their property value and may be a good fit for their products and services. It can be helpful for:

- Lenders to guide customers into a pre-underwriting flow.

- PropTech companies to bring people into their product for cross-selling other products and services.

- Investors to drive engagement to ultimately generate leads for possible acquisition.

HouseCanary’s Property Estimate is our marketing AVM and is available through our real estate data API, Data Explorer, for near real-time responses.