In real estate, multitasking is the norm, and there are never quite enough hours in the day. However, instant access to reliable data can help you move a little faster.

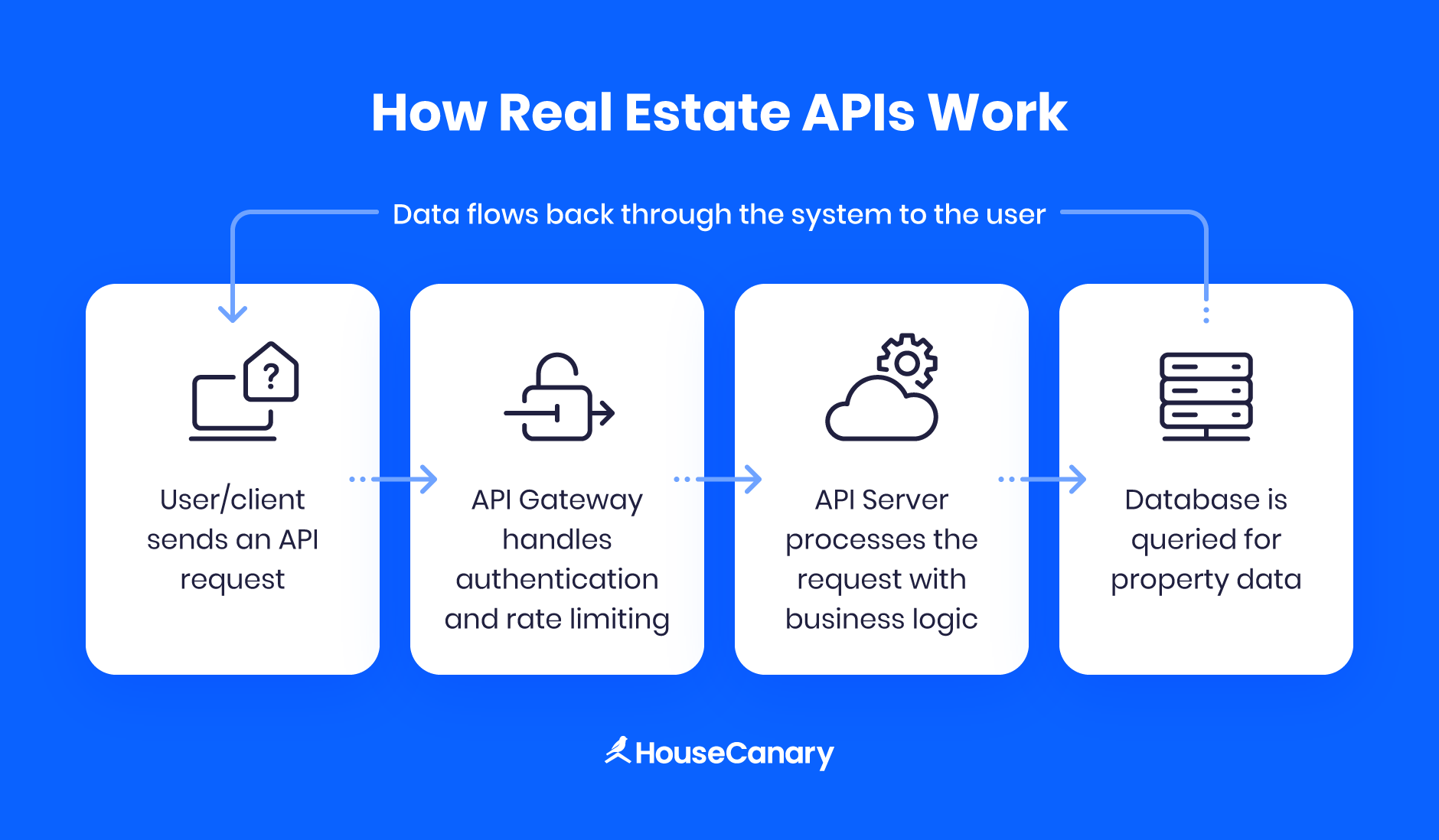

A real estate API (or application programming interface) is software that connects your website and internal tools directly to live property data. Valuations and forecasts update automatically alongside rental performance, market trends, and neighborhood context within the systems you already use. This helps reduce manual work and keeps decisions current.

In this guide, we’ll break down the 10 best real estate data APIs in 2026 and share practical use cases so you can choose the right solution.

What Is a Real Estate API?

An API in real estate is the bridge between your internal operational software and large-scale property databases, like HouseCanary. Instead of logging into multiple platforms or downloading spreadsheets, an API delivers structured property data directly into the tools you already use.

This can include CRMs, underwriting models, valuation engines, and real estate investment software. Every time a user searches an address or runs an analysis, the API pulls fresh information in real time.

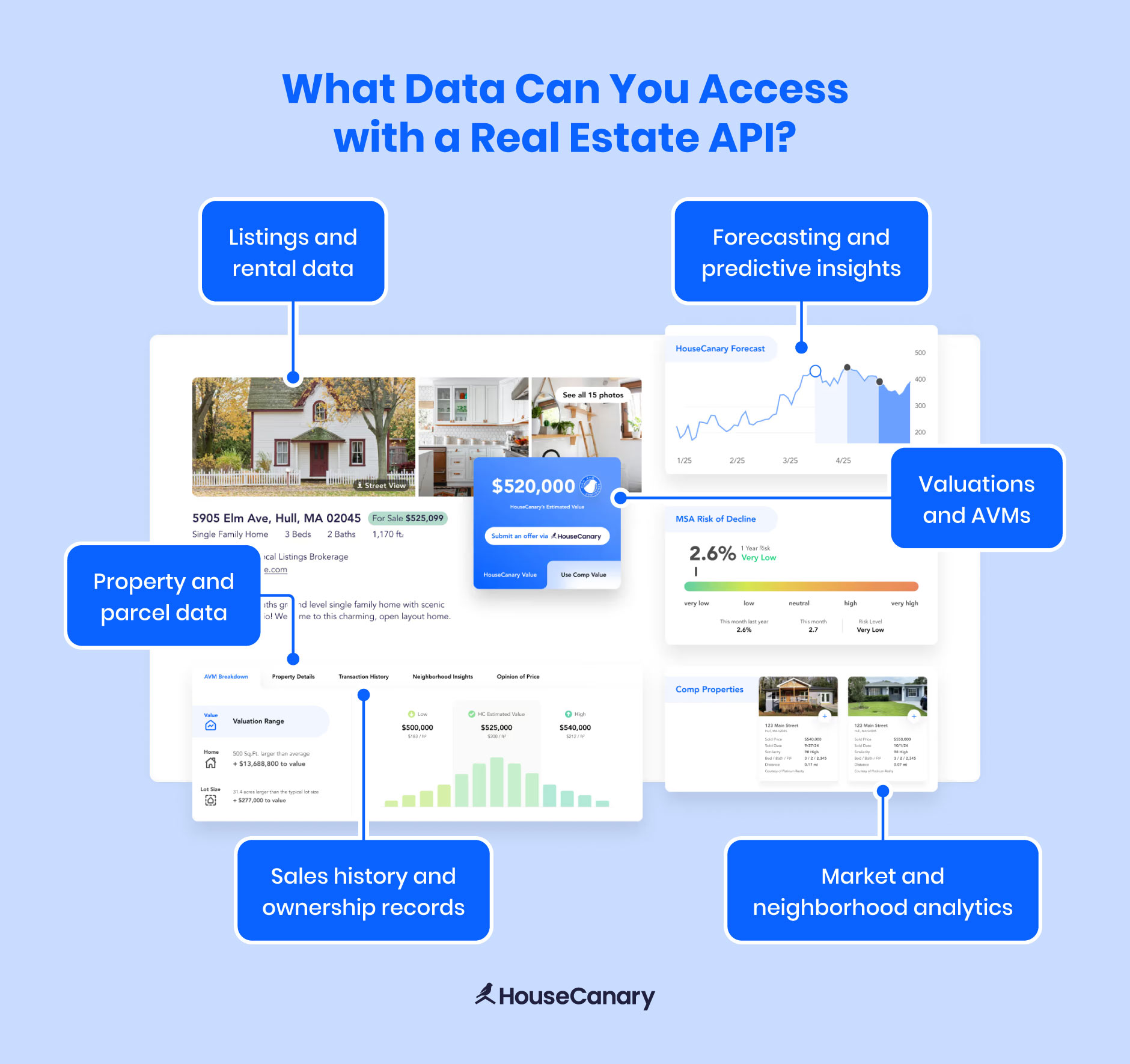

Most platforms focus on one or more of these data categories:

- Public record data: Property details and building characteristics, mainly reflecting past activity.

- Analytics and insights: Estimates, forecasts, and market trends that turn raw data into actionable intelligence for investors and lenders.

Together, these data types define what a real estate API can deliver. The best solutions provide a flow of reliable, real-time property data so you can make faster decisions without switching tools.

Top Real Estate APIs Overview

Many real estate APIs are available, but they’re not all built the same. The platforms below stand out for their data depth and reliability.

1. HouseCanary

Use cases: Unified valuation, forecasting, and risk analysis in a single data platform

HouseCanary’s Data Explorer API delivers granular and actionable real estate data. The platform provides 75+ data points covering individual properties, census tracts, ZIP codes, MSAs, and states. These elements are all enhanced with AI analytics that help you spot trends and risks from the block level up.

Through instant valuations and forward-looking risk signals, HouseCanary reduces uncertainty at every stage of analysis. The proprietary forecasting models project home price and rental performance up to 36 months. This supports more accurate underwriting and earlier identification of downside risk.

Rental value insights and market volatility metrics further support long-term planning, helping you anticipate performance rather than react to it. Ultimately, it streamlines analysis across your portfolio, making it easier to evaluate more opportunities with less friction.

Pricing: Basic plan $19/month

2. Mashvisor

Use cases: Investment and rental analytics

This platform focuses on rental property performance, offering ROI calculators, occupancy projections, and market heatmaps. Investors can quickly compare short-term and long-term rental opportunities.

Mashvisor’s API allows custom applications to access rental comps and investment metrics, making comparative market analysis and property scouting faster and more precise.

Pricing: Lite plan $49.99/month

3. ATTOM

Use cases: Property records and public data

Built for enterprise use cases, ATTOM offers comprehensive property intelligence that supports ownership research, tax analysis, and mortgage insights. The datasets cover everything from historical ownership to foreclosure records, making it a solution for due diligence and analytics.

The API also supports bulk queries, allowing platforms to ingest verified public records seamlessly. ATTOM is commonly used in workflows where property records need to be referenced or validated at scale.

Pricing: Professional plan $499/year

4. Zillow

Use cases: Listings and valuation

Zillow’s property details and proprietary Zestimate valuations make it a good option for general listing information. The data powers apps for real estate professionals who need instant property insights in a consumer-friendly format.

Through the API, developers can embed property facts, pricing estimates, and market information into custom tools. Zillow also enables apps to offer search functionality and home valuation insights without building extensive property databases from scratch.

Pricing: Starts free for limited use

5. RealEstateAPI.com

Use cases: Developer-focused property data

RealEstateAPI.com is a developer-focused option for flexible data needs. The platform aggregates public records, ownership history, sales data, and property characteristics into one API. You can also customize data for specific use cases.

The API supports high-volume requests and bulk data pulls, so it’s well-suited for large-scale operations. RealEstateAPI.com also handles normalization and transformation up front. This makes it easier to feed property data into analytics tools and AI workflows.

Pricing: Starter plan $599/month

6. Datafiniti

Use cases: Alternative and enrichment data

Datainfiniti’s API provides access to large-scale, normalized datasets that enrich traditional property data with broader context. The platform aggregates information from public sources, web data, and proprietary feeds. It also offers flexible filters so you can run address-level lookups and geospatial searches.

The API covers both residential and commercial property types and includes enrichment elements such as demographic indicators, nearby points of interest, and location-based attributes. Datainfiniti is a strong complement to core valuation or public record APIs for accurate property pricing.

Pricing: Tiered plans based on data volume and usage

7. Homesage.AI

Use cases: Valuation and market insights

Homesage.AI focuses on predictive analytics and forward-looking market insights. The platform also offers rental projections and property condition assessments, giving investors and developers a clearer picture of potential performance.

The API allows users to integrate pricing predictions, appreciation trends, and market scoring into investor reports or decision tools. Homesage.AI helps power data-driven investor reports and real estate platforms focused on future performance over historical results.

Pricing: Small Enterprise plan $200/month

8. RentCast

Use cases: Rental and market analytics

RentCast specializes in rental property data for both individual and commercial use. Its API delivers detailed property records, valuations, and market insights in a way that can be directly integrated into applications or dashboards.

The platform generates automated home value and rental estimates, while highlighting comparable properties and trends in local markets. Active listings are continuously updated so applications reflect current sale and rental activity, including pricing, market timing, and listing details.

Pricing: Free plan includes 50 API calls per month

9. PropStream

Use cases: Investment and property data

PropStream is designed for real estate investors who prioritize deal discovery and portfolio visibility. Rather than focusing on valuations alone, the platform brings together property activity, public records, foreclosure data, tax information, and owner insights to better evaluate potential investments.

PropStream’s API pulls data directly into investor dashboards, CRM workflows, or underwriting tools. This allows teams to surface equity positions, ownership history, and distress signals without switching platforms. It’s commonly used by residential investors and wholesalers who need to evaluate opportunities quickly across large property sets.

Pricing: Essentials plan $99/month

10. Google Maps

Use cases: Location data

Google Maps API adds geographic context that most real estate datasets can’t provide on their own. While it doesn’t deliver pricing or ownership information, it does help visualize how properties relate to their surroundings. Drive times, walkability, nearby amenities, and boundary mapping all help users understand location value at a glance.

Google Maps is often layered on top of valuation or property record APIs to create more intuitive experiences. The API can be used to plot parcels or show proximity to schools and transit. Ultimately, it helps turn raw data into interactive, map-based insights that are easy for clients and investors to interpret.

Pricing: Pay-as-you-go based on usage ($200 monthly free credit included)

What Is API Used for in Real Estate?

At the most basic level, APIs speed up real estate workflows by delivering live property data directly into the systems you already use. Instead of jumping between platforms or manually updating reports, APIs keep data flowing automatically and consistently.

Here are some of the most common real estate API data use cases:

- Investment analysis and deal screening: Evaluate properties faster by pulling valuations, comps, rental estimates, and market trends into underwriting models and investor dashboards.

- Mortgage underwriting and risk assessment: Support lending decisions with property data, ownership history, valuations, and risk indicators without manual data collection.

- Portfolio and asset management: Monitor performance across multiple properties using centralized data on values, rents, market shifts, and exposure.

- PropTech apps and consumer platforms: Power search, valuation, and mapping features that give users real-time property insights inside web and mobile applications.

- Market research, reporting, and forecasting: Generate market-level insights, forecasts, and reports using continuously updated data across neighborhoods or regions.

Many real estate APIs focus on a single layer of data, such as listings or public records. Platforms like HouseCanary combine valuation, AI tools, and market analytics in one API, making it easier to support multiple use cases without stitching together separate data sources.

How to Choose the Right Real Estate API

Choosing the right API comes down to how well the data fits your specific needs. Some platforms are built for housing market forecasts, while others are focused on listings and consumer-facing experiences.

Some of the top factors to consider:

- Data coverage and accuracy: Look at how comprehensive the dataset is across geographies and property types, and whether the data is validated or modeled for consistency.

- Forecasting vs. historical data: Decide whether you need forward-looking insights, historical trends, or both, depending on your focus.

- Update frequency: Real-time or near–real-time updates are critical for pricing, underwriting, and market analysis, while slower refresh cycles may be sufficient for research or reporting.

- Integration and scalability: Make sure the API is well-documented, supports high request volumes, and can integrate cleanly with your existing tools and data pipelines.

- Compliance, licensing, and usage rights: Confirm how the data can be used or displayed, especially if you’re building consumer-facing applications or monetizing insights.

Where Accuracy Meets Action: HouseCanary’s Real Estate API

HouseCanary’s real estate API provides advanced property context to help you evaluate market potential quickly. Unique data points like school proximity, frontage orientation, privacy scores, and environmental hazards provide a comprehensive view of each property.

Tap into the full power of HouseCanary by combining its rich datasets with market predictions, market trends, and customizable analytics. The platform offers flexible API access designed to support unique valuation, underwriting, and investment workflows.

Get started with HouseCanary today and turn data analysis into action.

Frequently Asked Questions

What Is the Best Real Estate API?

The best real estate API depends on your goals. HouseCanary’s Data Explorer API offers a comprehensive, all-in-one solution for those looking for property-level data and advanced forecasting metrics.

Do Real Estate APIs Include Forecasts?

Not all APIs offer forward-looking insights. HouseCanary stands out by delivering AI-powered forecasts, including rental projections, price growth estimates, and market volatility metrics.

.png)

.jpeg)