.jpeg)

Real estate has always depended on one main question: What’s this property worth? Traditionally, the answer came from time-consuming appraisals and market comparisons; however, now automated valuation models (AVMs) offer a quick analysis.

These data-powered algorithms can estimate home values in seconds, drawing from thousands of variables, like recent sales, market trends, and property characteristics.

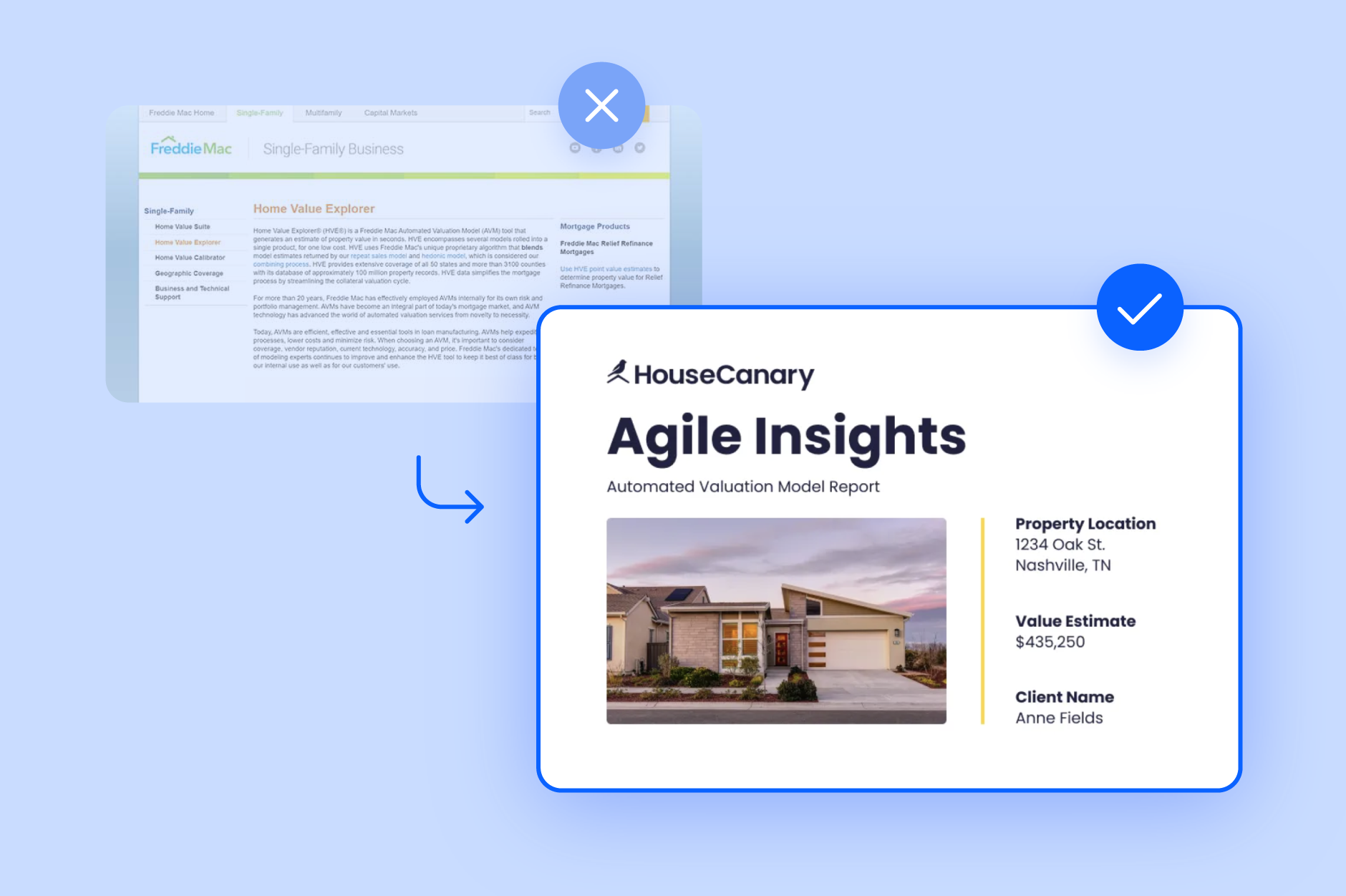

Leading providers like HouseCanary are helping investors, lenders, and appraisers better evaluate potential investments by combining massive datasets with advanced modeling. Let’s explore the core components of AVMs, how the industry uses them, and what sets the most accurate models apart.

What Is an Automated Valuation Model (AVM)?

An automated valuation model (AVM) is a technology-driven tool that estimates the value of a property using a combination of real estate data, comparable sales, and statistical or machine learning models. Instead of relying solely on a human appraiser’s judgment, AVMs deliver fast, objective valuations by analyzing thousands of data points in seconds.

At its core, an AVM pulls from key inputs like property characteristics (square footage, number of bedrooms, location), recent sales of comparable homes, and market trends. These inputs are processed through advanced algorithms to generate a property value estimate, often with a confidence score attached.

Real estate professionals use AVMs for everything from appraisal support and loan underwriting to portfolio valuation and listing price guidance. Their speed and scalability make them especially valuable for institutions that need to assess large volumes of properties.

Some AVMs go even further. HouseCanary, for instance, powers one of the most accurate pre-list AVMs on the market, helping investors and lenders make better-informed decisions before they list a home. This growing role of AVMs is reshaping how the industry approaches property valuation.

How AVMs Work

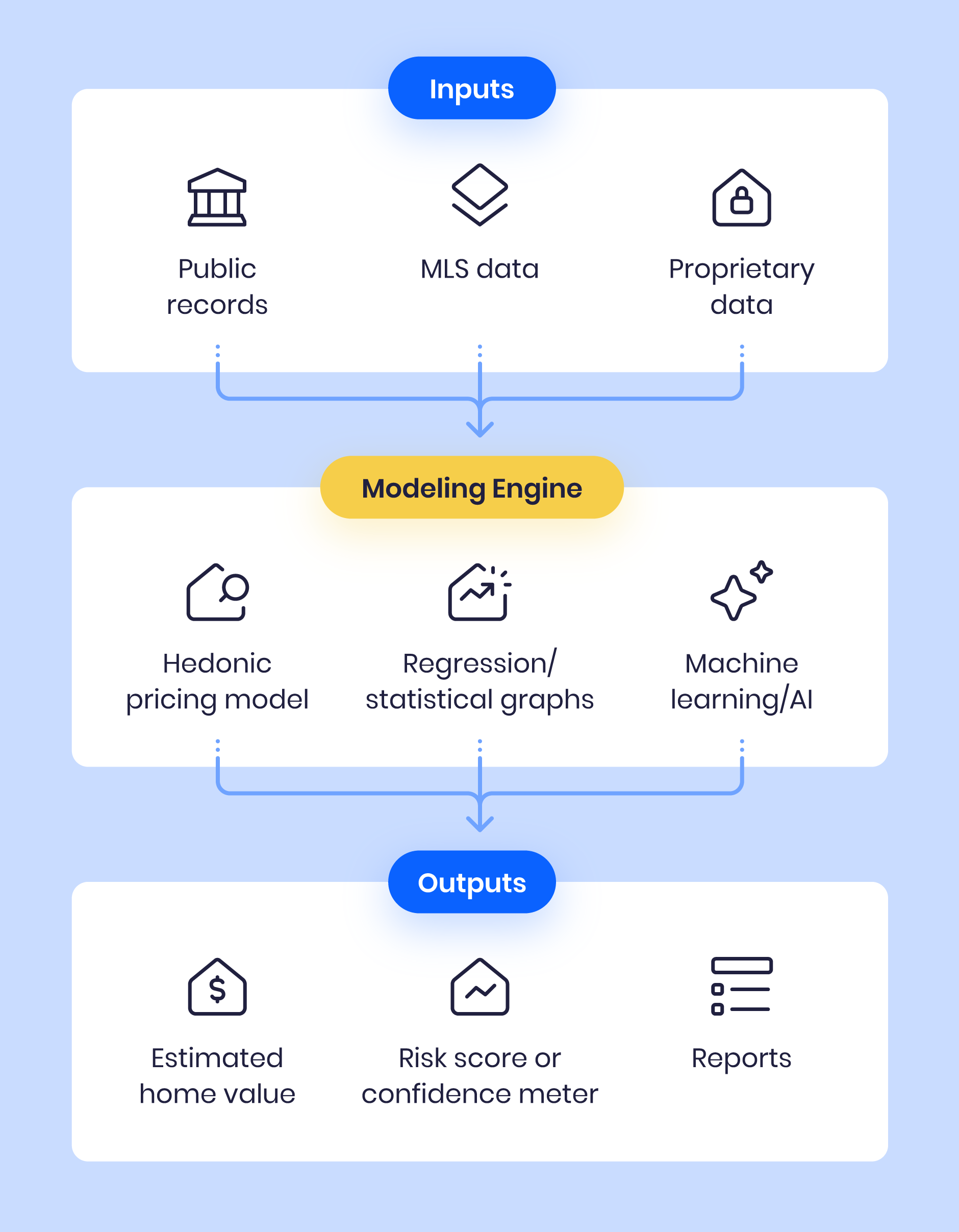

Automated valuation models in real estate combine massive datasets with statistical modeling to estimate property values instantly and at scale, often delivered through a real estate API. Inputs typically include public records, MLS data, and proprietary sources that enhance accuracy. For example, HouseCanary’s AVM leverages historical data, granular property characteristics, and local market trends to improve precision.

AVMs use modeling techniques such as hedonic pricing models and regression analysis to quantify how features like square footage, location, or recent renovations affect home value. More advanced models incorporate machine learning, allowing them to recognize complex patterns in the data and refine their estimates as new information becomes available.

While rule-based AVMs use static formulas, AI-powered AVMs adapt dynamically to market shifts and perform better across varied property types and regions. This evolution has made AVMs essential tools for today’s real estate leaders.

AVM vs. Traditional Appraisal

When it comes to valuing real estate, both automated valuation models and traditional human appraisals play important roles. Each approach has its strengths and is suited for different needs. Here’s how they compare across key factors:

- Speed

- AVMs deliver valuations almost instantly using automated data processing.

- Traditional appraisals require days or weeks due to site visits and manual analysis.

- Cost

- AVMs are more cost-effective, reducing the need for labor-intensive inspections.

- Human appraisals tend to be more expensive because of expert time and travel.

- Accuracy

- AVMs provide highly accurate estimates when backed by quality data and advanced algorithms.

- Traditional appraisals capture unique property details and local insights that AVMs may miss.

- Use Cases

- AVMs are ideal for quick underwriting decisions, portfolio valuations, and pre-list pricing.

- Traditional appraisals are preferred for final mortgage approvals, legal matters, and complex property assessments.

- Regulatory Compliance

- AVMs serve as complementary tools that provide scalable, data-driven insights within regulatory frameworks.

- Appraisals face stricter regulatory oversight and are often required for formal transactions.

Both AVMs and traditional appraisals offer valuable perspectives on property value. AVMs are best for speed, scalability, and cost-efficiency, while traditional appraisals bring human judgment and local expertise to complex or high-stakes decisions. Understanding their differences helps investors, lenders, and appraisers choose the right approach for each situation.

Accuracy and Limitations of AVMs

The reliability of an automated valuation model depends on several factors. When these are optimized, AVMs can deliver precise property valuations at scale.

Key elements of AVM accuracy include:

- Data quality and coverage: Accurate inputs are essential to producing meaningful valuations.

- Model sophistication: Advanced AVMs use statistical techniques, hedonic pricing models, and machine learning to detect patterns and refine predictions.

- Responsiveness to market volatility: The best AVMs adjust in near real time to shifts in pricing trends, interest rates, and local demand.

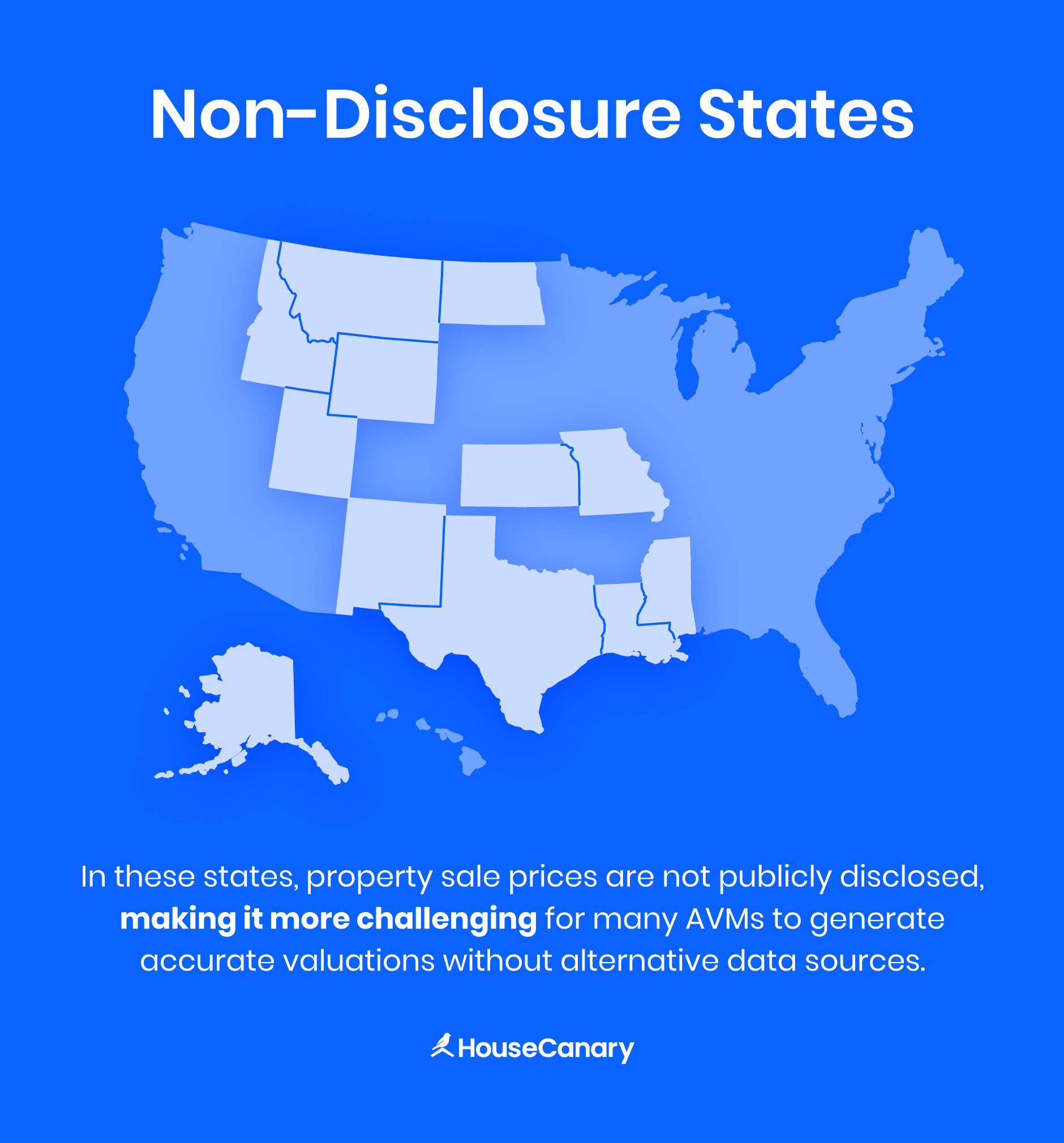

One of the most well-known limitations of AVMs arises in non-disclosure states, where officials do not publicly record sale prices. This creates challenges for any model that relies on accurate and timely comparable sales.

Despite this, HouseCanary’s AVM has demonstrated strong performance, including in non-disclosure states. Unlike many models that rely heavily on public sales data, HouseCanary’s AVM uses proprietary property-level data and machine learning algorithms.

It also incorporates non-traditional data sources such as listing activity, tax assessments, and neighborhood trends to fill gaps where traditional sales data is limited. This multidimensional approach enables accurate valuations even in markets where competitors struggle due to data scarcity.

Who Uses AVMs?

The real estate industry has widely adopted automated valuation models. Here’s a breakdown of the key users and how they apply AVMs in their workflows:

- Lenders: Mortgage lenders use AVMs during loan origination to quickly assess collateral value, helping determine loan-to-value (LTV) ratios and underwriting risk. Lenders also use AVMs for portfolio monitoring and risk modeling.

- Real estate investors: Investors rely on AVMs to evaluate acquisition opportunities and estimate market value across multiple properties at scale.

- Appraisers: While not a replacement for in-person appraisals, AVMs are a useful tool for appraisers to support value estimates, validate comps, and flag potential outliers or risks.

- Insurers and portfolio managers: Insurance companies and asset managers use AVMs to assess property risk exposure, update valuations for insured portfolios, and streamline revaluation processes for large real estate holdings.

As AVMs become more sophisticated and accessible, their role in decision-making continues to expand, offering an advantage across the industry.

Choosing the Right AVM Provider

Choosing the right automated valuation model software can significantly impact the accuracy and confidence behind your property decisions. When selecting an AVM provider, it's essential to evaluate several key criteria.

Top considerations include:

- Coverage: A leading AVM should offer national reach with high data fidelity, even in non-disclosure states or rural areas. Broad coverage ensures reliable valuations across your entire portfolio.

- Accuracy: HouseCanary stands out as the most accurate AVM provider based on independent third-party testing, offering industry-leading precision across various property types.

- Transparency and explainability: Users need to understand how the system calculates a value. Whether for regulatory audits or internal confidence, explainable models with clear outputs are essential.

- Customization: It’s increasingly important to tailor flexible AVM outputs to specific use cases, such as valuing a property in 'C3' condition or distinguishing between land and rental values.

- Support and integration: A responsive partner that offers strong customer support and seamless API or platform integrations makes adoption easier and more effective.

If you’re looking for the best AVM tool on the market, HouseCanary’s model stands out for its industry-leading performance and depth. HouseCanary’s AVM not only delivers exceptional accuracy and nationwide coverage but also leverages modern machine learning and image recognition to evaluate a property’s internal and external condition.

It incorporates nuanced data points, such as property views, to refine valuations further. The model can assess homes across six condition levels, allowing users to simulate different renovation scenarios and make more informed decisions. In addition, HouseCanary offers best-in-class Land and Rental AVMs and AI tools, further extending its valuation capabilities across asset types.

Choosing the right AVM provider can make the difference between a confident decision and a costly misstep.

Elevate Your Strategy with Trusted AVM Insights

The real estate industry is rooted in speed, competition, and complexity. This makes having access to fast, accurate property valuations a necessity. Whether you're a lender gauging risk, an investor evaluating opportunities, or an appraiser supplementing your expertise, a reliable automated valuation model provides a data-driven edge.

HouseCanary is committed to delivering AVMs that go beyond the industry standard, offering accuracy, extensive coverage, and trustworthy valuation methods.

To learn more about how AVMs power smarter real estate decisions, explore our AVM solutions or try our Property Explorer to experience HouseCanary insights in action.

.png)

.jpeg)